What the Housing Crisis Means for Today’s Youth

For today’s youth, owning a property is becoming increasingly tougher. According to housing charity Shelter, almost two million 20-34-year-olds are choosing to live at home with their parents as they cannot afford to rent or buy their own place, despite being in employment.

Being able to afford your own a house in today’s economy is hard and even for those lucky enough to be in employment, having enough money to put down a deposit and make the monthly payments on a mortgage is proving to be too much for many to even attempt. This means more youngsters are either staying at home with the parents to save money or they are getting trapped in a cycle of renting.

The house prices in the UK rose by 5.5% in December 2013 compared with the previous year. Rental costs have also increased and the expensive property market is a result of a number of contributing factors.

As a result, many young adults are being forced to live like teenagers in their parent’s house many years past their 18th birthday, in order to attempt to save the amount of money needed to pay the banks for a deposit.

So, what can be done to break the cycle of this worrying issue?

Knowing how much you need to save to put down an all-important deposit is imperative and this can be achieved by using various tools such as mortgage calculators.

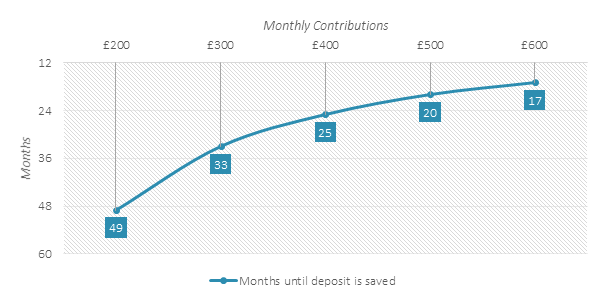

There are a few other handy tools that can be used to help to work out how long it will take you to save enough money to put down a deposit on a property based on your financial situation. Totally Money’s affordability tool is simple to use and you will be required to provide some basic information such as the area you wish to invest in and how much money you can afford to save each month, and the calculator will do all the hard work for you.

If you want to live in Stoke-On-Trent for example and you can afford to save £250 per month, you could afford a housing deposit in approximately three years and four months. This is based on the average house price in Stoke-On-Trent which is £69,552, and an assumed 15% deposit.

How long will it take me to buy in Stoke-On-Trent?

For many, saving for a house today is sadly nothing more than a future dream. Staying at home is a good way to save money as is house sharing, and it is vital to take advantage of tools such as mortgage calculators to calculate your financial situation and help to plan for the future.

Other resources:

You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.